Trend Finder Forex Trading Strategy The Trend Finder forex trading strategy can generate a good number of intraday forex signals and is able to determine changes in trend when the market is flat and trending equally. Chart Setup MetaTrader4 Indicators: TrendFinder.ex4 (default setting), TrendLinearReg.ex4 (default setting) Preferred Time Frame(s): 1-Minute, 5-Minute, 15-Minute, 30-Minute, 1-Hour, 4-Hour, Day Recommended Trading Sessions: Any Currency Pairs: All pairs Download Buy Trade Example Fig. 1.0 Strategy Long Entry Rules Place a buy entry if the following rules or conditions are in place: • If the red line of the TrendFinder.ex4 custom mt4 indicator crosses its blue line bottom up as shown on Fig. 1.0, it is an indication that price is being pressured to the upside i.e. A trigger to buy the pair of interest.

The Retracement Finder MT4 Indicator is a forex trading strategy which is based on mild price retracements. We can also call this an indicator retracement entry strategy. A retracement is defined as an area where price action which has been in a trend pulls back a little in the opposite direction as a result of profit taking, prior. How would you like to instantly know what the current trend is? How about the quality of that trend? Finding the trend on a chart can be subjective. The Fractal Trend Finder indicator examines the chart for you and reveals what the current trend is based on objective criteria. Using the Fractal Trend Finder.

• If the histogram of the TrendLinearReg.ex4 custom mt4 indicator aligns above the 0.00 signal level, price is said to be pushed higher i.e. A trigger to go long. The lime green color above the 0.00 level denotes a very strong bullish trend, while red histograms that are aligned above the 0.00 signal level denotes weaning bullish sentiment. Stop Loss for Buy Entry: Place stop loss below immediate support. Exit Strategy/Take Profit for Buy Entry Exit or take profit if the following holds sway on the activity chart: • If the red line of the TrendFinder.ex4 custom mt4 indicator crosses its blue line top downwards placing itself above blue line (refer to Fig. 1.0), an exit or take profit is advised. • If red histograms of the TrendLinearReg.ex4 custom mt4 indicator forms below the 0.00 signal level during a long entry, price is said to be reversing, hence an exit or take profit is crucial.

Sell Entry Rules Initiate a sell order if the following chart or indicator pattern gets displayed: • If the red line of the TrendFinder.ex4 custom mt4 indicator crosses its blue line top downwards as depicted on Fig. 1.1, it is an indication that price is being pushed lower i.e. Adobe Cs5 Universal Keygen By Core Download more. A trigger to sell the pair of interest. • If the histogram of the TrendLinearReg.ex4 custom mt4 indicator aligns below the 0.00 signal level, price is said to be pushed lower i.e.

A sell trigger. The red color below the 0.00 level denotes a very strong bearish trend, while lime green histograms that are aligned below the 0.00 signal level denotes the resumption of bulls pressure. Stop Loss for Sell Entry: Place stop loss above immediate resistance. Exit Strategy/Take Profit for Sell Entry Exit or take profit on position(s) if the following holds true: • If the red line of the TrendFinder.ex4 custom mt4 indicator crosses its blue line bottom up placing itself below blue line (prefer to Fig.

1.1), an exit or take profit is advised. • If lime green histograms of the TrendLinearReg.ex4 custom mt4 indicator aligns above the 0.00 signal level during sell order(s), price is said to be making a U-turn, hence an exit or take profit is crucial. Sell Trade Example Fig. 1.1 Free Download About The Trading Indicators The real creator behind the TrendLinearReg.ex4 custom indicator is Sergej Solujanov, and the indicator is designed to spot trend changes. The indicator can be traded by observing when it crosses the zero line (just as we’ve exemplified), touches the peak value or even trading zone breakout. The TrendFinder.ex4 custom indicator is a trend following technical study just as the name implies, and is comprised of two lines (red and blue), where buy/sell signals are triggered off when these lines cross.

Trend Trading is an indicator designed to profit as much as possible from trends taking place in the market, by timing pullbacks and breakouts. It finds trading opportunities by analyzing what the price is doing during established trends.

• Trade financial markets with confidence and efficiency • Profit from established trends without getting whipsawed • Recognize profitable pullbacks, breakouts and early reversals • The indicator analyzes its own quality and performance • It includes a multi-symbol and multi-timeframe scanner • The scanner scans all the instruments in the Market Watch• It implements a multi-timeframe dashboard • The indicators are non-repainting • It implements email/sound/visual alerts Established trends offer dozens of trading opportunities, but most trend indicators neglect them completely! The Trend Trading indicator displays an average of 10 different trades per trend. • (1) is a bullish trend change • (1) is a bearish trend change • (2) is a pullback in the direction of the trend • (3) is an inside bar(s) breakout in the direction of the trend • --- is a correction during a downtrend • --- is a correction during an uptrend • Blue Bars are a bullish secondary trend • Red Bars are a bearish secondary trend Boost your trading returns with the most complete trend trading indicator available, just like hundreds of customers have already done. A brief introduction Established trends offer dozens of trading opportunities, but most trend trading indicators neglect them completely, and leave the trader completely uninformed about what the market is doing during a trend! The average trend indicator only informs about trend changes, but that is simply not enough to achieve exceptional returns.

The Trend Trading indicator displays up to 20 times more trades than the average trending indicator, because it pays attention to what is known as market timing. It displays, not only the current market trend, but also pullbacks, breakouts of inside bars and corrections. It allows you to hop on a trend just after a retracement has taken place, pyramiding positions safely using breakouts of inside bars and also to find potential reversals, known as corrections.

Recommendations for Novice Traders The Pz Trend Trading Indicator has endless possibilities but novice traders should focus on the easiest trading setups, which are (2) pullbacks and (3) breakouts of inside bars, because they are calculated taking into account the prevailing trend direction and recent price action. More than 85% of the pullbacks and breakouts are profitable, and some of then turn into really long, profitable trades. Novice trades should also avoid trying to exit the trade at the best possible point, and reduce the position management to a simple trailing stop using the main line of the indicator.

This eliminates room for anxiety or judgment errors and allows profits to run. Novice traders should stick to this position management strategy until they can pyramid positions comfortably. Novice traders should trade daily and weekly charts, to avoid wild volatility swings or paying outrageous brokerage commissions compared to the potential profits of their trades. The market is pretty much like a video-game which has different levels. Novice traders should not trade H4 charts until they are constantly profitable in D1 and W1 charts. Understanding the trading setups The market evolves and revolves around different stages, with only one goal in mind: race up or down with as fewer participants as possible.

The market will always retrace and try to stop you out, testing your stamina and discipline over and over again. The price is ultimately unpredictable. This is why you need different trading setups: to react properly to what the market is doing. The key to profitable trading is adaptability. By learning four trading setups you will be able to trade any market in any stage without staying on the sidelines while the market is moving strongly. The following graph illustrates all the trading setups and the different market stages where they take place.

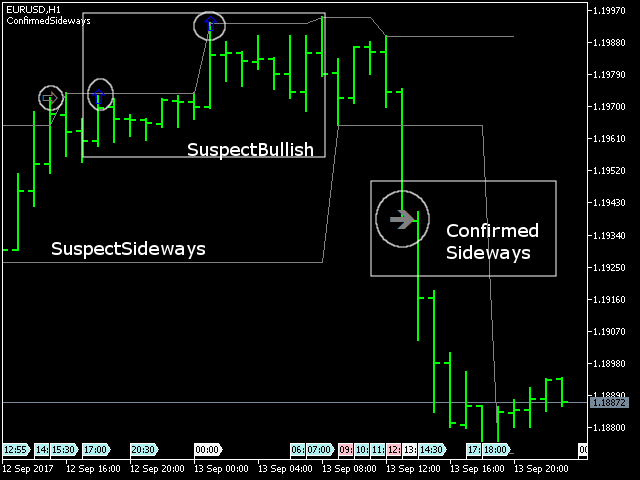

(1) Trend Changes A trend change takes place when the market changes its direction. Trend changes are displayed on the chart using colored circles with a number one in it.

A blue (1) signals the start of an uptrend, and a red (1) signals the start of a downtrend. Trend changes are not the result of evaluating recent price action, which means that the trading setup has no timing. If you are using this indicator properly, by the time a trend change has taken place, you will be already in the market (see corrections below). (2) Pullbacks Once a trend is in motion, the market shakes up and down as winning hands reap profits and other market participants get into the market. A pullback is a retracement during a trend that represents a good buying opportunity, normally caused by big players reaping profits and selling their shares.

If the market resumes up after a pullback, the indicator will plot an orange (2) on the chart. Pullbacks are very good trading opportunities but might not take place during very strong trends. (3) Inside Bar(s) Breakouts An inside bar is a bar (or a series of bars) that is completely contained within the range of the preceding bar, which is known as the mother bar. The breakout of an inside bar (or bars) represent the most profitable trading setup during established trends, because the risk reward ratio is extremely high: it is a high-probability entry point that provides traders with a good risk reward ratio since it typically requires smaller stop losses than other setups. The indicator will plot a (3) when a breakout of an inside bar (or bars) has taken place, and it is a great opportunity to hop onto the trend or to pyramid your positions safely. (---) Corrections or Reversals A correction is a liquidation of shares that is strong enough to trigger a pullback if the market resumes its direction, or a trend change if the price correction reaches the trendline. Every pullback and trend change is, always and in all cases, preceded by a correction.

The indicator will plot a colored dash when a correction is detected, a red dash (---) is a bearish correction during an uptrend and a blue dash (---) is a bullish correction during a dowtrend. Razor Crack Gta 4. Corrections represent great trading opportunities, giving you the opportunity to trade against the prevailing trend before it actually reverses. Furthermore, the risk reward ratio is enormous, because the initial stop-loss can be fairly tight. However, it is extremely important to make sure the trend is weak before taking the trade. You should trade corrections confirmed by one or more of the following: • An oscillator divergence is confirming the correction • A double top or double bottom pattern is present • A head and shoulders pattern is present Bear in mind that the market does not simply reverse: every trend moves until exhaustion, and only then reverses. The key is confirming the trend exhaustion before the market has reversed, and using a correction signal to get into the market ahead of the crowd. After some time using the Pz Trend Trading Indicator, you will spot exhaustions easily.

When loading the indicator to any chart, you will be presented with a set of options as input parameters. Don't despair if you think they are too many, because parameters are grouped into self-explanatory blocks.

Indicator Settings Under the indicator settings block, you will be able to set the indicator period and choosing what trading setups must be displayed. You can display or hide pullbacks, trend bars, breakouts and corrections. The MaxHistoryBars parameter controls how many past bars are examined to minimize memory usage. Drawing Settings Choose the color and width of the correction lines displayed on the chart. Alerts Enable display/email/push/sound alerts for all the trading setups enabled. Does the indicator repaint or backpaint? No, the indicator is non-repainting and non-backpainting.

What should I trade with this indicator? Trade everything! Any market with price and volume is suitable for trading. We trade indexes, forex, commodities and stocks. I am a novice trader.

Can this indicator be useful to me? It will keep you on the right side of the market and prevent costly mistakes. Can I move the dashboard on the chart? Yes, you can drag and drop the dashboard anywhere on the chart.

Will this indicator make me a profitable trader? Trading requires skill and no tool can replace you. But one thing is for sure, this indicator will improve your trading returns.

Just don't panic if you have some down months. Trading is a waiting game and profits come in bunches: you sit, you wait, and you make a lot of money all at once. Is this just another trend trading indicator which gets whipsawed to death? No, it is not. The PZ Trend Trading indicator solves the timing problem by detecting pullbacks and breakouts.

Some trend changes will inevitably retrace and stop you out, but pullbacks and breakouts increase your payoff more than enough to obtain exceptional returns. How much trading time is required to achieve good results? If you follow a trend following system, very little. Most top traders manage their trades in 10 to 30 minutes per day, which is enough to check the state of the market and update their positions. Trend following, unlike high-frequency trading, uses weekly and daily data and needs little or no attention during the day.

What timeframe should I trade? We suggest trading Weekly, Daily and H4 charts. Because we don't like to work that much or paying a fortune in commissions. Intraday trading is very fashionable and exciting, but succumbs to decreasing profit potential and increasing trading commissions. The ultimate winners of scalping are brokers, and most traders resort to intraday charts because their expertise doesn't allow them to find enough trading opportunities in daily charts. Does this indicator implement alerts? Yes, it implements email, sound, push and visual alerts for every trading setup.